As inflation moved rapidly to a multi-decade high in 2022, Treasury Inflation-Protected Securities (TIPS) ETFs became a popular investment option to help protect portfolios. But understanding how TIPS work is not always straightforward. They have some unique characteristics that can sometimes make the investing experience confusing.

Here are answers to some of the most frequently asked questions about TIPS.

Inflation protection

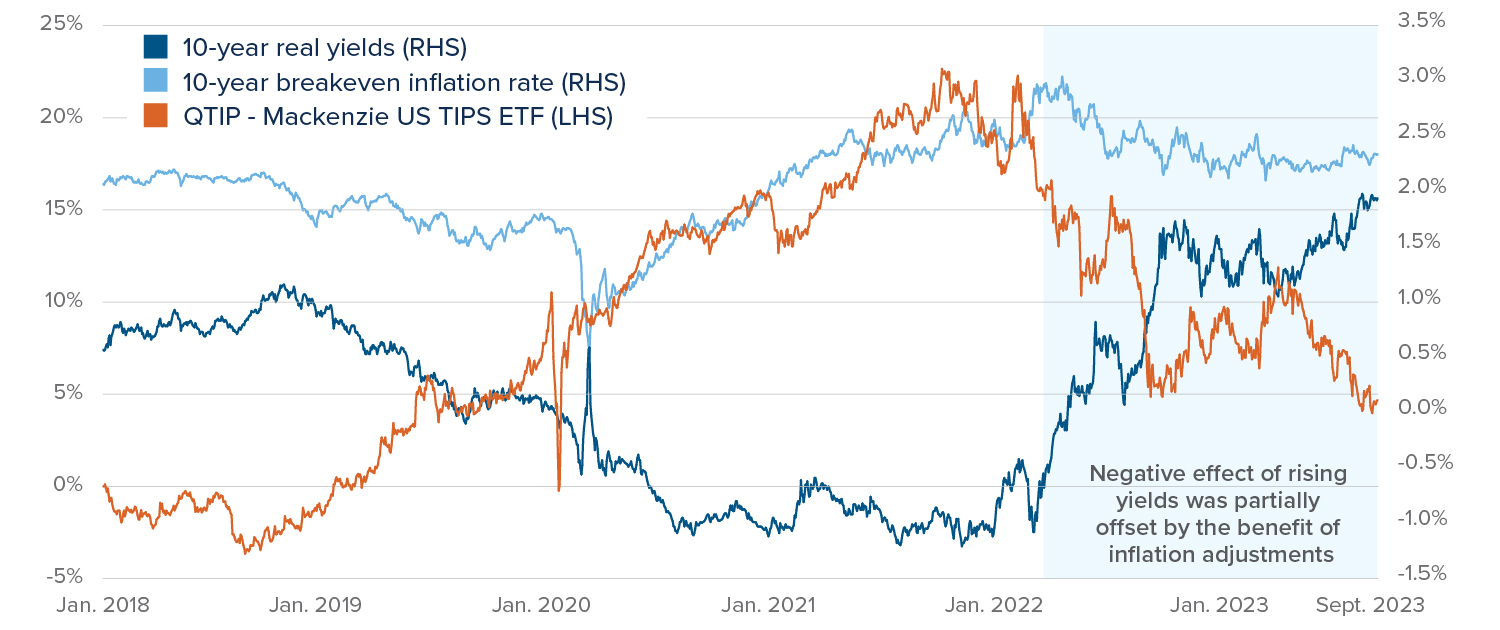

TIPS are designed to help investors preserve their purchasing power and protect their investment returns as their principal is adjusted for inflation. Inflation is particularly concerning for bondholders since it can erode the value of future interest and principal payments. TIPS offer a “real” rate of return that adjusts for inflation as interest is paid on the adjusted face value of the bond, creating a gradually rising stream of interest payments, as long as inflation continues to rise.

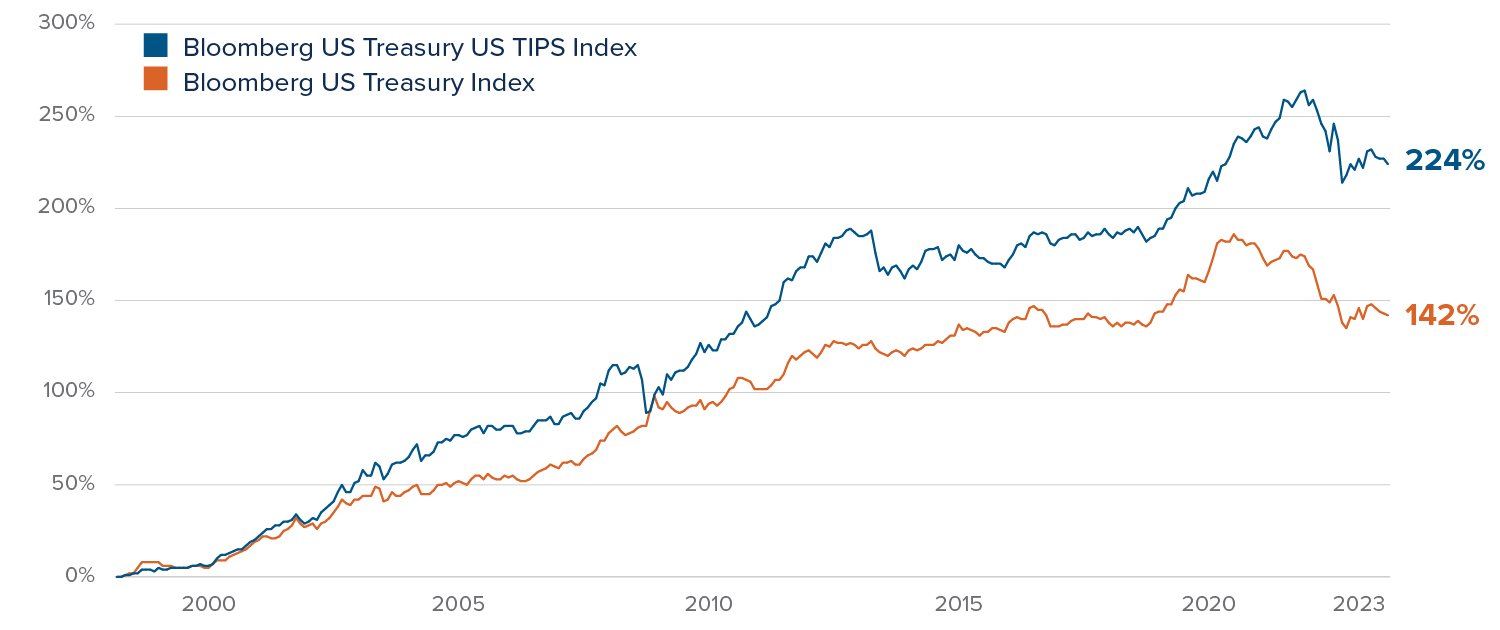

Long-term total return

The compounded effect of principal adjustment helps TIPS deliver a better long-term total performance relative to nominal bonds.

Inflation protected versus nominal bonds

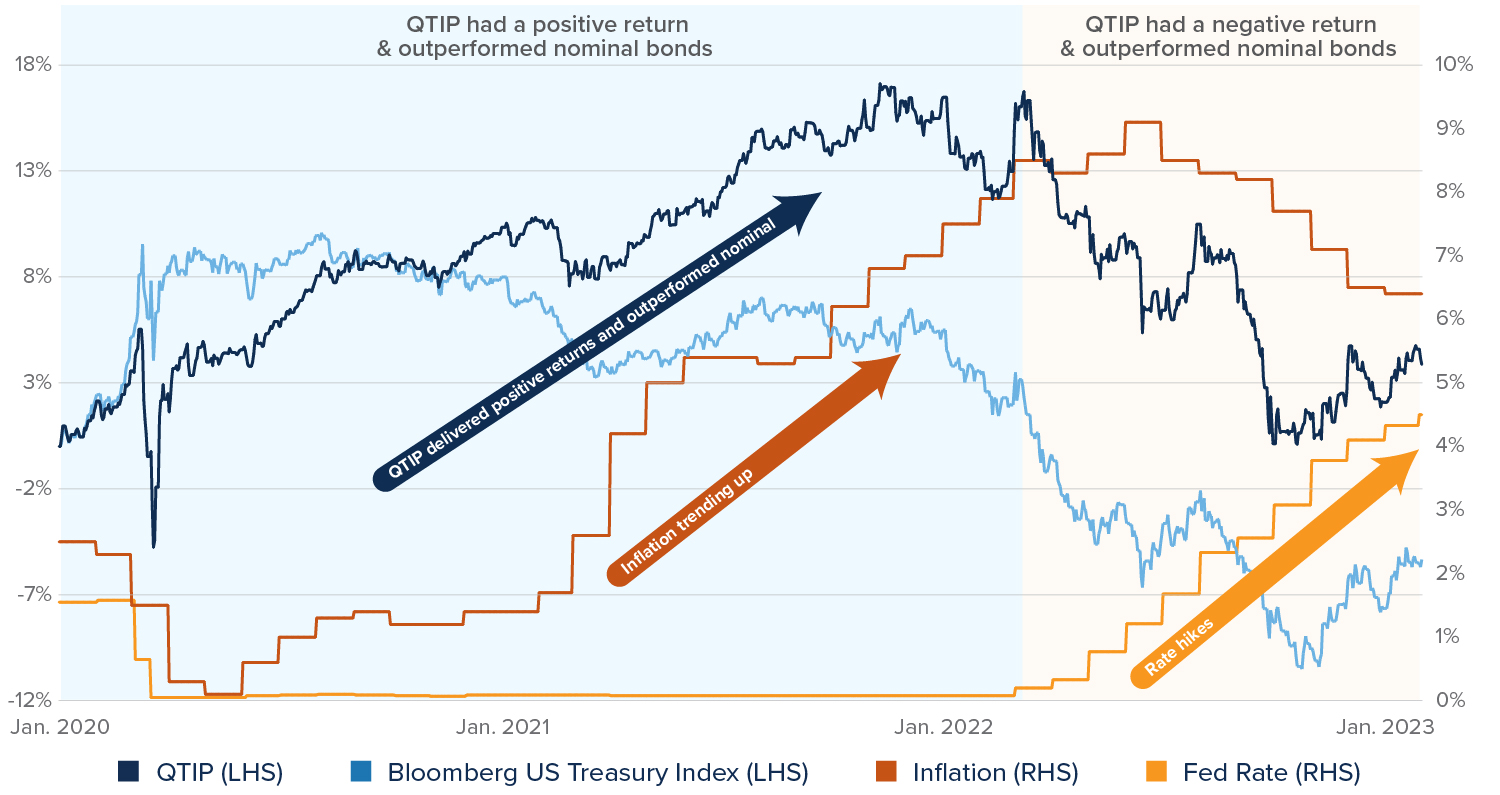

In March 2022, the US Federal Reserve began an aggressive rate hike campaign to combat rising inflation. Through year end, the rates increased by a total of 4.25%, which was the fastest rate hike cycle in decades. During the same period, QTIP registered a loss of 11%, primarily due to its duration risk amid the unprecedented speed of the rate hike cycle.

Source: Morningstar, as at January 31, 2023.

Commissions, management fees, brokerage fees and expenses may all be associated with Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The Mackenzie ETFs are not sponsored, promoted, sold or supported in any other manner by Solactive nor does Solactive offer any express or implicit guarantee or assurance either with regard to the results of using the Indices, trade marks and/or the price of an Index at any time or in any other respect. The Solactive Indices are calculated and published by Solactive. Solactive uses its best efforts to ensure that the Indices are calculated correctly. Irrespective of its obligations towards the Mackenzie ETFs, Solactive has no obligation to point out errors in the Indices to third parties including but not limited to investors and/or financial intermediaries of the Mackenzie ETFs. Neither publication of the Solactive Indices by Solactive nor the licensing of the Indices or related trade mark(s) for the purpose of use in connection with the Mackenzie ETFs constitutes a recommendation by Solactive to invest capital in said Mackenzie ETFs nor does it in any way represent an assurance or opinion of Solactive with regard to any investment in these Mackenzie ETFs. This should not be construed to be legal or tax advice, as each client’s situation is different. Please consult your own legal and tax advisor.