Written by the Mackenzie Fixed Income Team

Key Highlights

- Market participants divided about the true neutral Fed Funds rate, with estimates ranging from 275bp to 400bp

- A weaker Canadian economy could mean the BoC’s policy rate could diverge significantly from the Fed’s rate in 2025, potentially exceeding a 100bp difference.

- Stabilizing global inflation and easing central banks could support inflation-linked bonds and selected credit assets.

- Expect Bank of Japan to hike rates by 25bp this year, with some opposition seen as election rhetoric

- The team reduced exposure to long-duration bonds, anticipating that yields will rise due to an improved US economic outlook.

- We favor high-grade Canadian corporate bonds at the short end of the curve, mindful of potential US election uncertainties impacting fiscal policies and inflation.

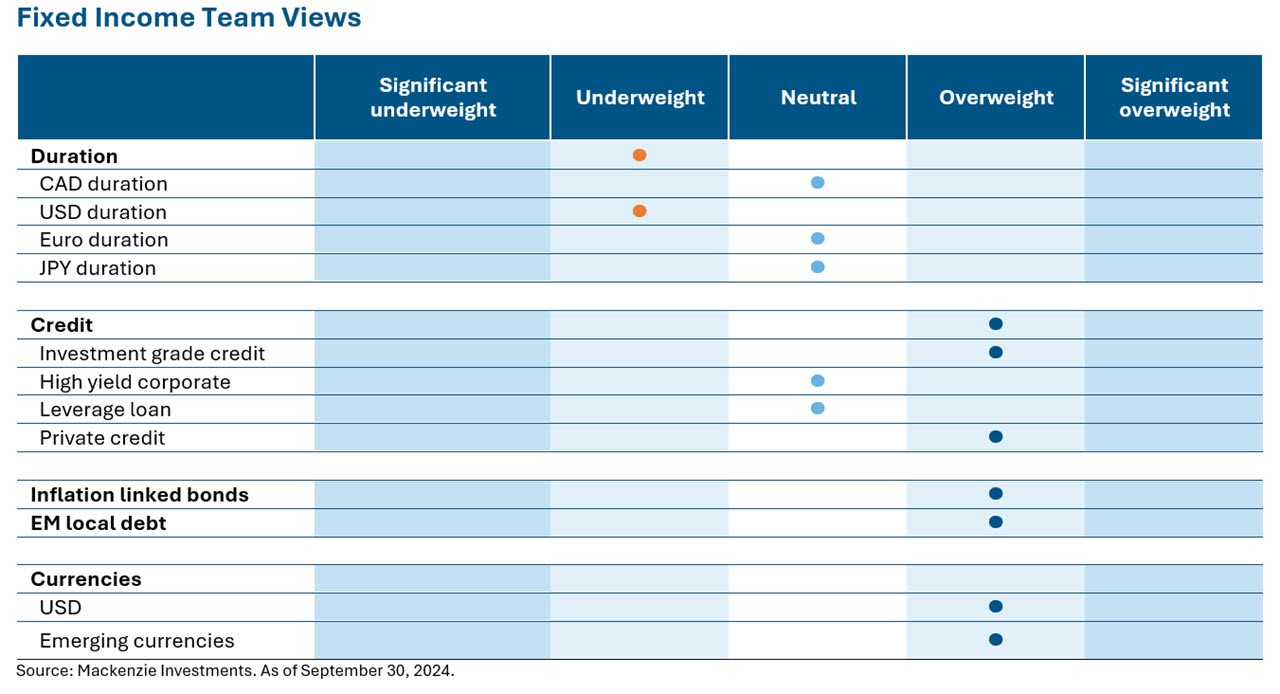

Fixed Income Team Views

Central Bank Watch

US Fed (Fed)

Earlier in the month, Nonfarm payrolls (measures the number of employees on payrolls) showed a lower net gain of 142k but employment in July was 88k lower than previously reported. Headline inflation continued to trend lower with a 2.5% print for August. The central bank kicked off its easing cycle and opted for an outsize 0.50% cut in its September meeting lowering the fed funds target range to 4.75%-5%. Investors are split over whether it will take a similar step or opt for a smaller move in November. The Federal Reserve’s preferred measure of underlying US inflation and household spending, core PCE, rose modestly in August to 2.7% y/y, underscoring a cooling economy. The economy expanded at a 3% pace in Q2, stronger than previously expected, spurred by consumer growth fueled by robust incomes. Stronger data points led to recalibration of terminal policy rate expectations higher and consequent rise in treasury yields near the end of the period.

Bank of Canada (BoC)

The BoC cut its policy rate by 25 basis points for a third straight meeting to 4.25%. The decision to lower rates was based on easing inflationary pressures and growing slack in the economy. Policymakers see further easing in broad inflationary pressures, with excess supply continuing to put downward pressure on price gains and with shelter inflation starting to slow. Canada labor market continued to show signs of weakness as the unemployment rate rose to 6.6% with the labor force increasing more rapidly. Headline inflation for August surprised on the downside at 2% led by decline in transportation prices. Lower inflation and rising unemployment keep the October policy meeting active, sparking a debate on the size of the potential rate cut.

European Central Bank (ECB)

The ECB reduced interest rates for a second time this year, bringing the deposit rate to 3.5% from 3.75% on building economic concerns and plunging inflation. Headline inflation declined to 2.2% year over year in August from 2.6% in July contributed largely by lower energy costs. Services inflation rose to 4.1% in August remains uncomfortably high and troubling for some members of the Governing Council. Traders now predict two quarterly rate cuts by the year end.

Bank of Japan (BoJ)

Japan’s headline inflation accelerated for the fourth consecutive month in August. Despite this, the BoJ kept the policy rate at 0.25%, remaining cautious about an October rate hike due to concerns over the market meltdown following July’s rate increase. The BOJ’s policy making is also at a delicate point after the Fed outsized interest-rate cut, which initially pushed the yen higher versus the dollar. Any more hawkish signals from the BOJ could strengthen the yen further, which in turn could weigh on Japanese exporters’ share prices.

Emerging Markets (EM)

Mexico’s headline inflation slowed to 4.7% in the first two weeks of September, almost a percentage point lower than the mid-July print, and the once-sticky core component has also decelerated to 4%. Banxico, reduced borrowing costs by 0.25% to 10.5% for a second straight meeting as the economy heads for a third year of slower growth. While the rest of the world is easing policy rates, Brazil Central Bank raised its policy rate by 25 bps to 10.75%, just three meetings after the final cut on the back of resilient economic growth South African local bonds outperformed most EM local rates, bolstered by political stability since the elections in June and the onset of the easing cycle by the South African Reserve Bank.

Duration and Curve Positioning

Given the ongoing strength in the US economy, there is continuing market debate about where the true nominal neutral Fed Funds rate stands. The Fed would currently have the market believe “R-star” is around 275bp +/- 25bp, but there are those in the market who believe it is significantly higher, as high as 400bp. When it comes to the BoC’s policy rate, this is an important discussion point about how far the policy spread can stretch. Traditionally, the BoC’s policy rate does not sway too far from the Fed although there are times where it can materially exceed plus-or-minus 100bp. We believe we could be entering one of those policy differential eras in 2025. Through the month, the team reduced US duration exposure by underweighting long-duration bonds, believing the fixed income rally is overextended and expecting yields to rise due on an improved US economic outlook. With global inflation stabilizing and central banks gradually easing, inflation-linked bonds could maintain relative stability in the face of moderate inflation expectations. Credit spreads remain tight, and we prefer to be invested in high-grade (low beta) Canadian corporate bonds at the short end of the curve. We are cognizant that the upcoming US election and the uncertainties it might bring – from fiscal concerns to tariffs to the potential for a re-emergence of inflation – can quickly alter base-case outlook. We believe the BoJ aims to further normalize rates and will likely hike by 25bp this year. We see Ishiba’s comments against a rate hike as election rhetoric, given his historically hawkish stance on Japanese rates and FX. Looking ahead, easing monetary policies should create a supportive environment for spread sectors and selected credit assets. However, geopolitical risks and the upcoming U.S. elections could introduce increased volatility in fixed income markets

Investment Grade Corporates (IG)

US IG credit returned 1.8% and CA IG 2.1% as duration did most of the heavy lifting while spreads tightened during the month despite record September issuance. Spread performance was uniform across ratings buckets within IG, though A-rated paper outperformed notable. The best performing sectors in US include Utilities given lower interest rates and the flattening spread curve, Life Insurance, Transportation and Metals & Mining. Credit spreads remain tight, and we prefer to be invested in high-grade (low beta) corporate Bonds at the short end of the curve. We prefer the Canadian curve over the US curve in this sector. Continued rate cuts are the base case for Canada and so there is still further potential for significant price appreciation of these securities.

High Yield Bonds (HY)

In September, the HY index saw a gain of 1.62%, with notable outperformance in the Cable/Satellite (+5.1%), Telecom (+3.8%), and CCC-rated bonds (+4.9%). High-yield bond yields and spreads decreased by 35bp and 14bp, respectively, bringing them to 7.10% and 345 bp. Sector-specific strength was evident, with CCC-rated bonds outperforming the HY index by the widest margin since December 2019. The current high yield spread reflects the strong economic backdrop and expectations of a soft landing, supported by the anticipated rate-cutting cycle. If these rate cuts do not occur as expected, spreads may widen and yields could rise, that could weigh on the economy.

Leveraged Loans (LL)

Loans gained 0.71%, continuing to underperform high-yield bonds for the fifth consecutive month as the Federal Reserve begins its easing cycle. After experiencing significant volatility in August, the secondary market has since stabilized. Higher-rated BB loans underperformed, while CCC loans rallied to a seven-month high. Secondary loan yields, currently at 9.54%, have decreased by approximately 75 basis points over the past year, reaching their lowest levels in nearly two years. Loans continue to benefit from elevated base rates and stand to benefit from the resilience of the US economy.

Bond Stories

Investment Grade – Canadian Banks Bond Exposure

Since the onset of the rate-cutting cycle, our Canadian bank exposure has significantly benefited from the easy monetary policy implemented by the central bank. The Bank of Canada cut its key interest rate by 75 basis points between June and September 2024. A steeper yield curve boosts banks’ net income by enhancing the spread between their borrowing costs and lending revenues.

Canadian banks reported positive 3Q24 earnings growth despite increases in loan loss provisions. Strong domestic banking, wealth management, and capital markets performance, along with improved cost controls, helped offset increases in LLPs and allowance builds. This has led Canadian households to save more, reducing their discretionary spending compared to U.S. households. Overall, the rate-cutting cycle has provided a favorable backdrop for our Canadian bank holdings, contributing to portfolio growth and stability.

High Yield Bond – Frontier Communications

Frontier is a wireline company providing broadband services to 2.9 million subscribers in 25 states. The company is an industry leader in fiber internet deployment and currently passes 7.2 million premises with fiber connectivity, giving the company a strong competitive advantage. In recent quarters, Frontier consistently outperformed its peers and achieved increasing subscriber count, positive revenue momentum, and mid-single-digit EBITDA growth. On September 5th, Verizon Communications announced an all-cash acquisition of Frontier valued at $20 billion. Strategic rationale for the deal included accelerating Verizon’s own fiber buildout with Frontier’s best-in-class footprint, converging with wireless assets to provide competitive product bundles, and driving significant cost synergies while remaining accretive to Verizon’s financial metrics. Given Verizon is a BBB+ rated entity and is planning to refinance Frontier’s debt immediately upon close, bond prices across the capital structure appreciated significantly and were notable contributors in September.

Leveraged Loan – ScionHealth

ScionHealth is a health services provider operating in two businesses. It has a portfolio of 18 short-term acute care hospitals in 16 non-urban markets in 13 states, and 76 long-term acute care hospitals (LTACs) in its Specialty hospital segment. LTACs provide post-acute care to patients with chronic critical illness. The company’s performance in 2022 and 2023 has been challenged by higher labor expenses and higher interest rates on its floating rate debt. S&P added a Negative Outlook to its B- rating in December 2023 – reflecting higher than expected leverage. The company has been able to improve its margins in cash flow in 2024, but the progress has been slow. Recent events have improved the outlook and resulted in a 10+ point jump in the term loan price. ScionHealth reached an agreement with Ventas in September that will reduce rent expense on 23 of its LTACs whose lease term is scheduled to mature on April 30, 2025. Ventas also agreed to acquired real estate and related property of 5 performing LTAC assets for a gross purchase price of $189 million, and ScionHealth will lease these facilities for an initial 10-year term. This will provide the company with ample liquidity to reduce its debt and improve its operating performance.

ESG – Medical Properties Trust

Medical Properties Trust (MPT) is a REIT formed in 2003 to acquire and develop net-leased health care facilities. Hospital operators were pressured in 2022 and into 2023 from labor shortages and in some cases rising interest rates which resulted in elevated labor costs and lower profit margins. MPT has been working with its largest tenant Steward Health Care as they entered bankruptcy in May 2024. In September, MPT reached a global settlement with Steward and its lenders that restores MPT’s control over its real estate, severs its relationship with Steward, and facilitates the immediate transition of operations to quality replacement operators at 15 hospitals across the United States. Based on new lease agreements, MPT expects to receive annual cash rent payments of $160 million on this portfolio’s approximate $2.0 billion lease base upon stabilization. MPW bonds rallied on the news yet still yield upwards of 10% which suggests further upside given the company’s credit profile and strong asset value.

We consider MPT to be in best-in-class on ESG characteristics primarily because of the social good provided by the hospital and health care assets that they own. They issued their first corporate responsibility report in 2021 and a follow-up report in 2023 and again in 2024 that highlight how tenants representing 80% of revenue were making progress on reducing GHG emissions in their operations and that 60% by square footage have carbon reduction goals. They now have green leases representing 9.3 million square feet of medical facilities that represent 18% of their portfolio (by square feet). They are also building a new Net-Zero Green Headquarters near their current head office in Birmingham, Alabama that will feature 47 acres of natural forest preservation and is expected to be completed in 2025. MPT has also been listed as Best Places to Work for multiple years according to Modern Healthcare.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of August 31, 2024, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of September 30, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.